Lifetime investment success is not a function of skill… it is a function of behaviour.

Holistic

Financial Planning

The relationship between you and your financial advisor is built upon trust and the understanding that both of you are on the same page and working towards the same outcome. A one size fits all approach usually fails to address the finer details of why you have crossed paths.

You have likely been referred to us with a specific need in mind or a problem that requires solving. Whatever the reason, our approach is always to go back to basics and to look at your specific situation as the new starting point. What are your goals, what do you value in life and how can we ensure your resources are aligned with what’s really important to you? Let’s re-look at the big picture together and ensure you are working towards what you value in life.

Our initial meetings are always free and without obligation and used as a starting point for building that long-lasting relationship. These meetings are important from an information sharing point of view as well as a chance to discuss what is important to you, which allows us the chance to ensure each plan aligns your values with your financial plan.

Tell me and I forget. Teach me and I remember. Involve me and I learn.

– Benjamin Franklin –

What is

Holistic Financial Planning

Holistic Financial Planning simply put is the process and planning that goes into helping you achieve what is most important to you in life, through the proper management of your resources. We believe that life is meant to be lived and we want to be that partner that handles the burden of financial management, freeing you up to pursue what truly matters to you. Through discussing your motivations, your fears and your objectives, we can help define your goals for the future.

Instead of focusing on a specific area of your finances in isolation, such as investments, retirement funds, tax or insurance; we define holistic financial planning as considering all aspects of your personal circumstances and financial position to identify the actions that need to be taken to meet your goals for the future. Your goals drive the planning process and rather than needing to sell financial products, we take into account where you are today, where you want to be and then create a plan to support you in getting there.

An important part of building a holistic financial plan is to be mindful of, and adequately protected against, events that could derail your financial plan. These events could include a long-term illness, a market downturn or the death of a loved one. We would always ensure that these considerations are brought in to focus, to help determine whether any action needs to be taken.

Maybe you want to retire at 55, or perhaps you just want more freedom to travel. Whatever it is, write it down. These are your markers in the sand, the very reasons as to why you’re working, saving and investing your hard-earned money. Holistic financial planning starts with the end in mind and works back from there. If you don’t know what you want from life, you have no framework for making financial decisions. You get out of life what you put into it. We want to help you determine what this end goal looks like.

putting the

plan into action

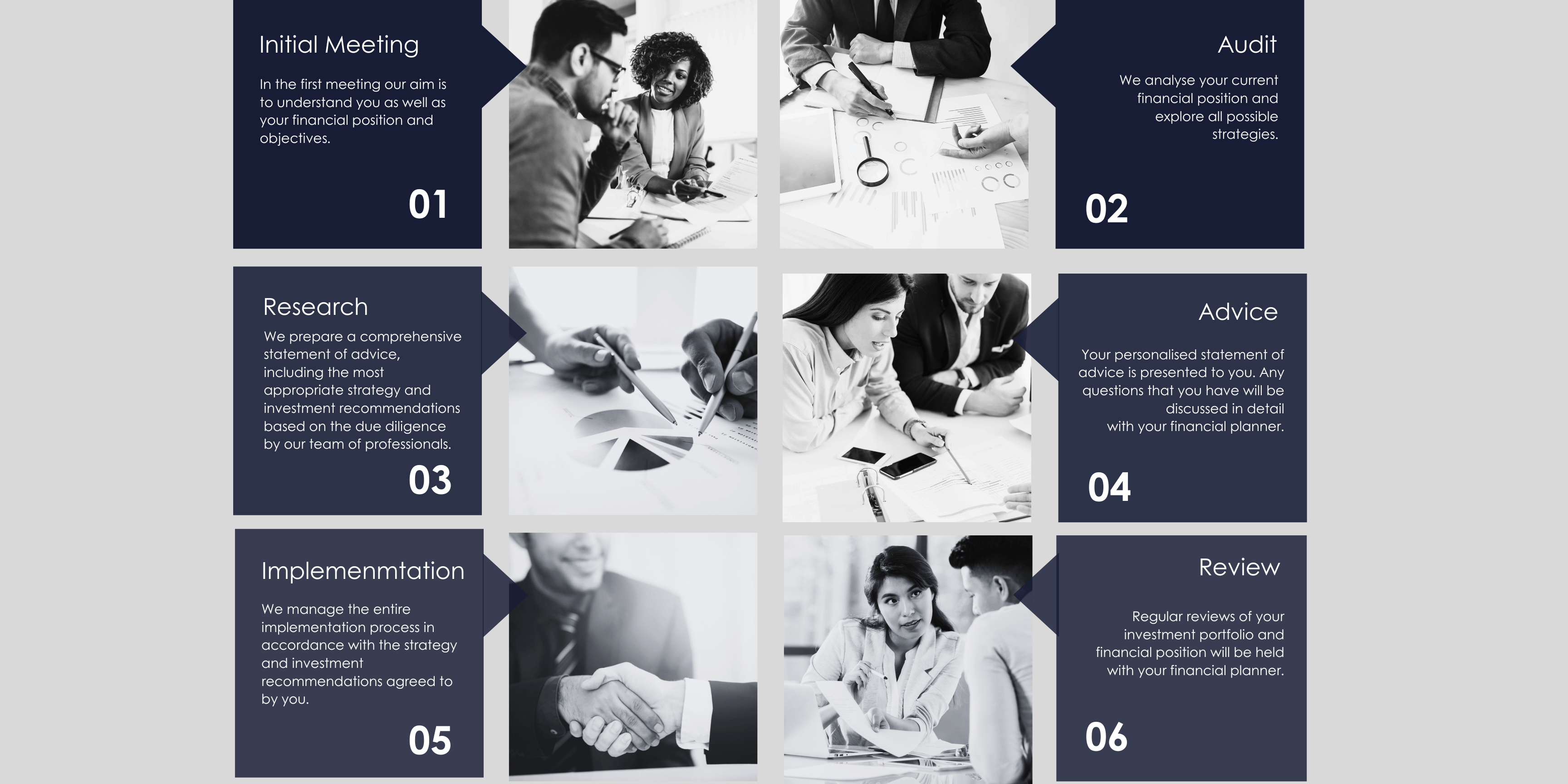

Once we have agreed the basis of our relationship with you, we will undertake a detailed analysis of your existing portfolio, circumstances and the goals we have discussed.

Being an independent business, we remain impartial on which solutions we recommend to you. We have access to all providers which allows us to determine the most suitable solution for your needs, ensuring that the outcome is always optimal for your personal situation.

keeping in

Contact

We believe regular reviews are a crucial element to any holistic financial plan. It is inevitable that financial plans will be affected by changes in legislation, economic conditions and your personal circumstances and goals over time.

It is for this reason that we review these factors with our clients at least annually, to ensure that every plan is tailored to reflect any new threats or opportunities that arise.

Go confidently in the direction of your dreams! Live the life you’ve imagined.

– Henry David Thoreau –

Benefits of a

Holistic approach

Holistic financial planning provides direction and meaning to your life. Your personal goals sit at the heart of holistic financial planning, meaning that any plan created through this approach is tailored to you. Holistic financial planning benefits you in taking a big picture view of your situation.

This approach allows you to avoid the potential pitfalls of focusing on decisions in isolation, where consideration may not have been given to how one course of action could affect another aspect of your finances.

One of the key advantages of holistic financial planning is that, by identifying where you are now and what you want to achieve, it can give you clarity on whether or not your goals are realistic and tangible. Having this peace of mind helps to empower you when making financial decisions, by allowing you to prioritise your goals and determine what (if any) sacrifices need to be made.

what is an

Independent Certified Financial Planner CFP®?

A certified financial planner (CFP®) is someone who uses the financial planning process to help you implement strategies aimed at meeting your life goals. The CFP® can take a “big picture” view of your financial situation and make financial planning recommendations that are right for you. The CFP® can look at all your needs including budgeting and saving, taxes, investments, insurance, estate and retirement planning. A CFP® may work with you on a single financial issue but within the context of your overall situation. It is this big picture approach to your financial goals that set the CFP® apart from other brokers, who may have been trained to focus on a narrow aspect of your finances or to simply sell you a product.

Add independence to the CFP® and you have an unbiased, arms-length professional who will enhance the quality of advice given.

You know where you want to be, you know where you are today and you have a plan for bridging the gap. But without taking action, nothing is going to change. You need to physically make the changes that have been identified with your financial planner. Nothing is going to change unless you change it. Here is where working with an independent CFP® can help. They will check in with you regularly, holding you accountable to your actions, encouraging you to follow through. Your fulfilment is our reward.

Resolute Wealth Management is an authorised Financial Services Provider – FSP No: 13798